snohomish property tax rate

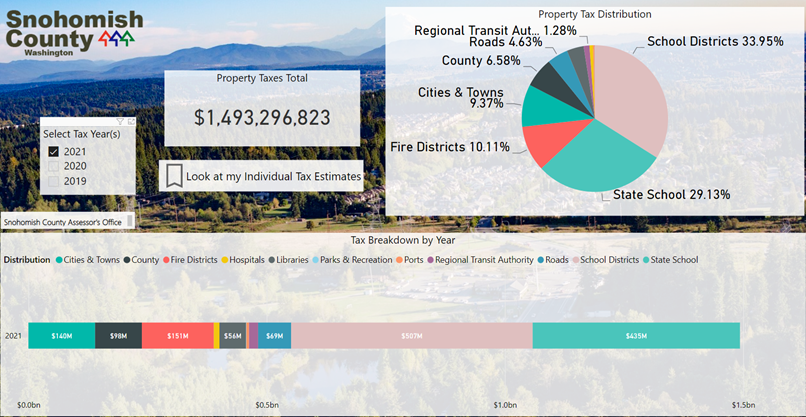

The Department of Revenue oversees the administration of property taxes at state and local levels. Snohomish and every other in-county public taxing unit can now calculate needed tax rates since market value totals have been determined.

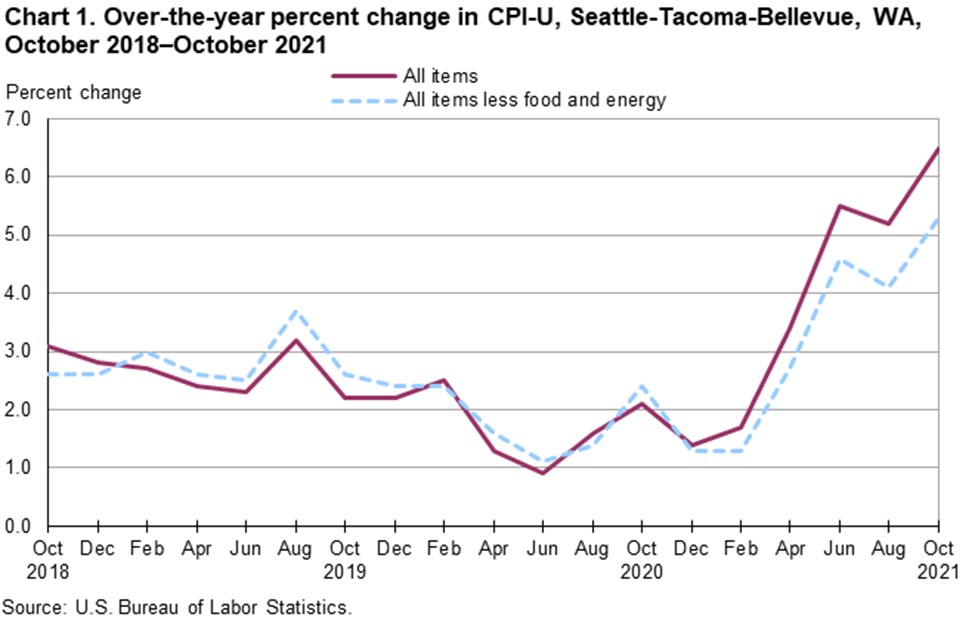

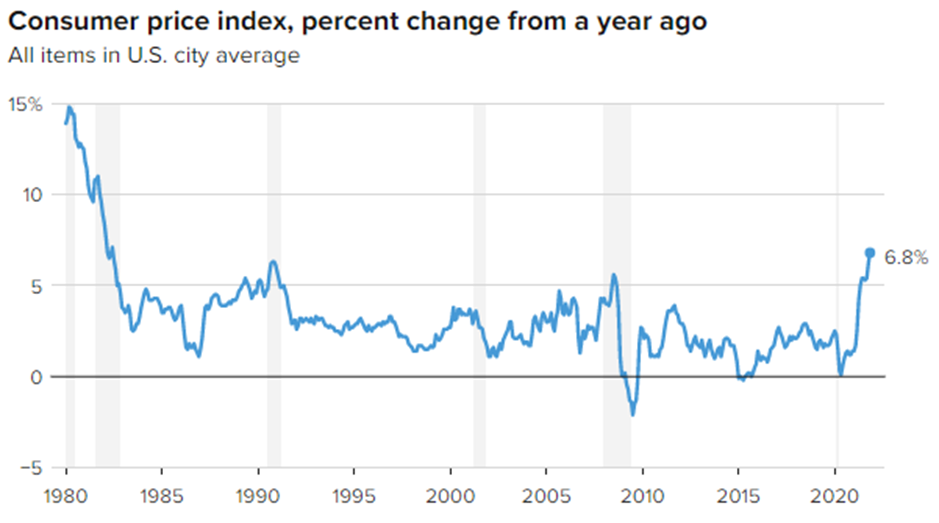

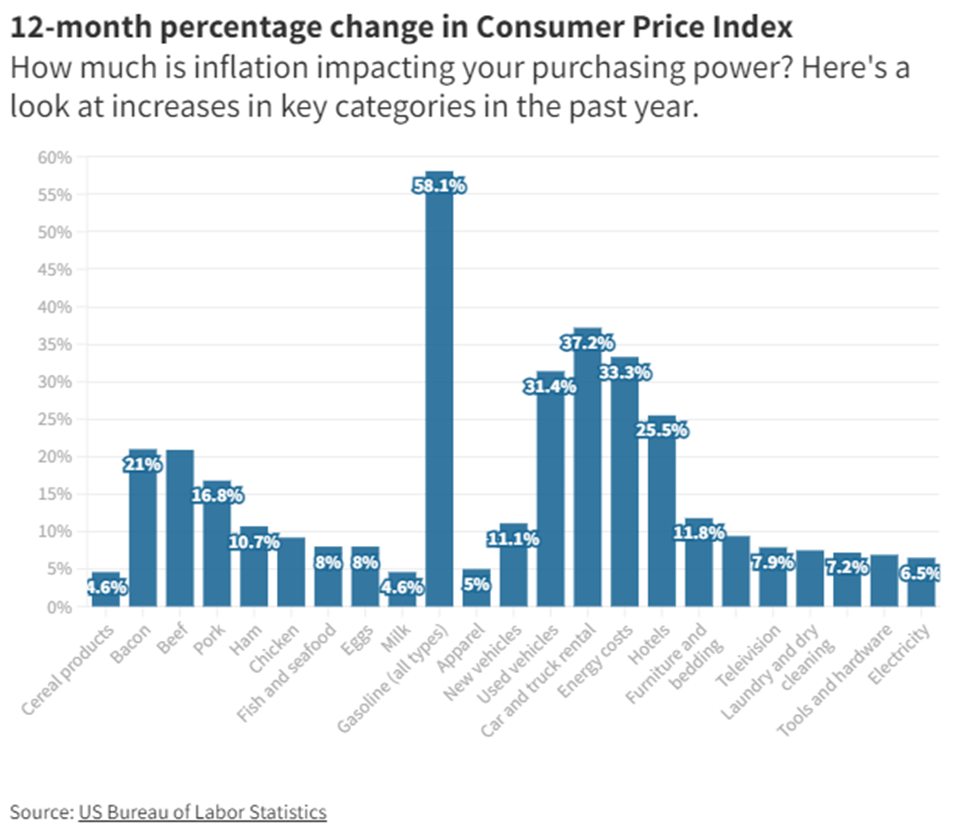

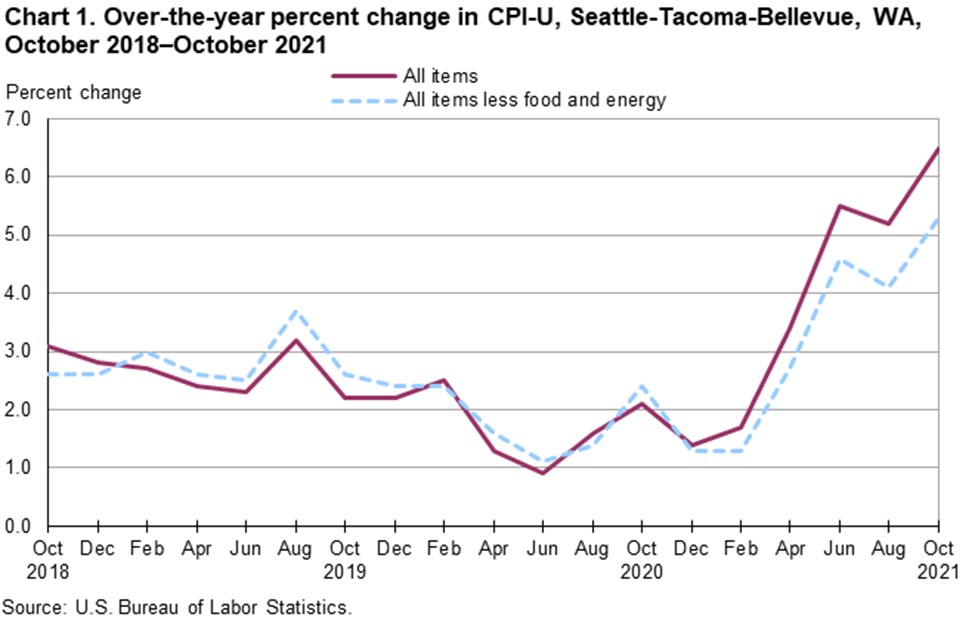

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

This is the total of state county and city sales tax rates.

. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Snohomish County Tax Appraisers office. Snohomish WA 98291-1589 Utility Payments PO. Additional tax payment options including online payment options are.

MS 510 Everett WA 98201-4046 Ph. Property Tax Exemptions Email the Property Tax Exemptions Division 3000 Rockefeller Ave. Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related.

State Laws Revised Code of Washington RCW Pertaining to Property Taxes. The Washington sales tax rate is currently 65. In case you missed it the link opens in a new tab of your browser.

Property taxes have increased in recent. In our oversight role we conduct reviews of county processes and. The Snohomish Washington sales tax is 910 consisting of 650 Washington state sales tax and 260 Snohomish local sales taxesThe local sales tax consists of a 260 city sales tax.

If you have questions you can reach out to our staff via phone email and through regular mail as well as visit our customer service center on the 1st floor of the Administration East Building on. Levy Division Email the Levy Division 3000 Rockefeller Ave. Box 1589 Snohomish WA 98291-1589.

How was your experience with papergov. Snohomish WA 98291-1589 Utility Payments PO. The assessed value of your property is multiplied by the tax rate necessary in your levy area to produce your fair share of the total levied tax by these jurisdictions.

The minimum combined 2022 sales tax rate for Snohomish Washington is 93. The median property tax also known as real estate tax in Snohomish County is 300900 per year based on a median home value of 33860000 and a median effective property tax rate. In this mainly budgetary function county and local public leaders estimate annual spending.

It could have been better. When summed up the property tax burden all owners shoulder is created. Snohomish County Government 3000 Rockefeller Avenue Everett WA.

Please call 425-388-3606 if you would like to make payments on your. Accounts with delinquent taxes must first be approved by the Snohomish County Treasurers Office. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The countys average effective tax rate is 119. Washington has a 65 sales tax and Snohomish County collects an. Non-rta Washington sales tax is 890 consisting of 650 Washington state sales tax and 240 Snohomish County Unincorp.

The Snohomish County Unincorp. A penalty of 3 shall be assessed on the amount of tax delinquent on June 1 of the year in which the tax is due. Explore important tax information of Snohomish.

The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information. Credit card payments can be made over the phone by calling 833-440-3332 or by visiting our payment site here. The median property tax.

An additional 8 shall be assessed on the total amount of tax delinquent on.

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

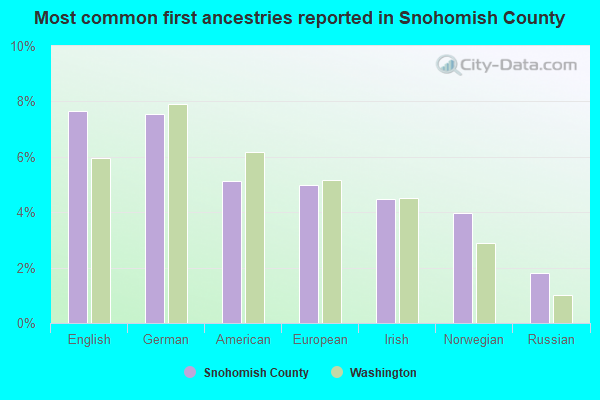

Snohomish County Washington Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Investor Alert 6 6 Cap Rate For This Well Maintained 8 Unit Townhome Complex First Time On Market Since Construc Curb Appeal Home Schooling Craftsman Style

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Breathtaking Views Of The Cascade Mountain Ranges And Snohomish River Valley In An Established Secluded Quiet Neighborho Backyard Front Deck Outdoor Structures

Pin By The Platz Group On Homes For Sale In Snohomish County Marble Tile Floor Corner Fireplace Outdoor Decor

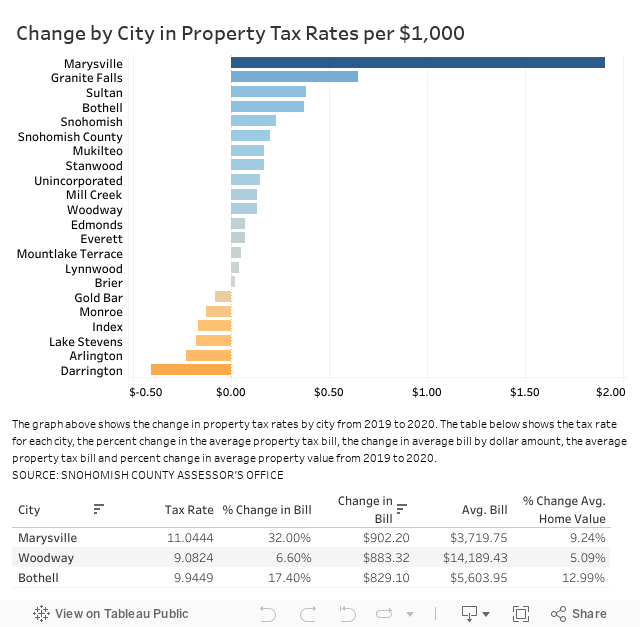

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Graduated Real Estate Tax Reet For Snohomish County

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

What Snohomish County Would Pay And What St3 Would Deliver Heraldnet Com

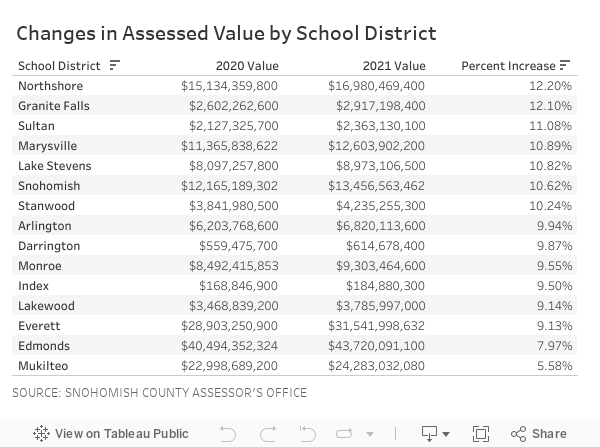

Snohomish County Home Values Soar In Latest Assessment Heraldnet Com

Property Taxes And Assessments Snohomish County Wa Official Website

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Mountlake Terrace City Council Approves Property Tax Increase Code Updates Mltnews Com

Property Mls 1693341 10413 240th Place Sw Edmonds Wa 98020 In Snohomish County Wa Has 4 Bedrooms 1 Backyard Views Low Maintenance Yard Real Estate Trends